Alternative Capital

Private credit for resources, energy, acquisition and property development, refinance, manufacturing, global projects, leveraged buy-outs to $2-50 million

Property Development

Plug the gap between senior bank debt. Access private credit for property pre-construction and land-banking, option finance, refinance holding stock.

Resources & Energy, Oil, Gas

Structured debt and equity, off-take and production finance for new energy projecys and mining services companies supporting exploration to production.

Acquisitions

Leverage against assets to acquire or merge for expansion, roll-ups, buy out your competitor or shreholder. Add another complimentary division to expand services.

Manufacturing & Trade

Bespoke funding solutions for trade, importers and exporters. Streamline global payments, equipment or inventory. Scale-up local manufacturering.

Working Capital Finance Australia $50 million +

What is Alternative Capital?

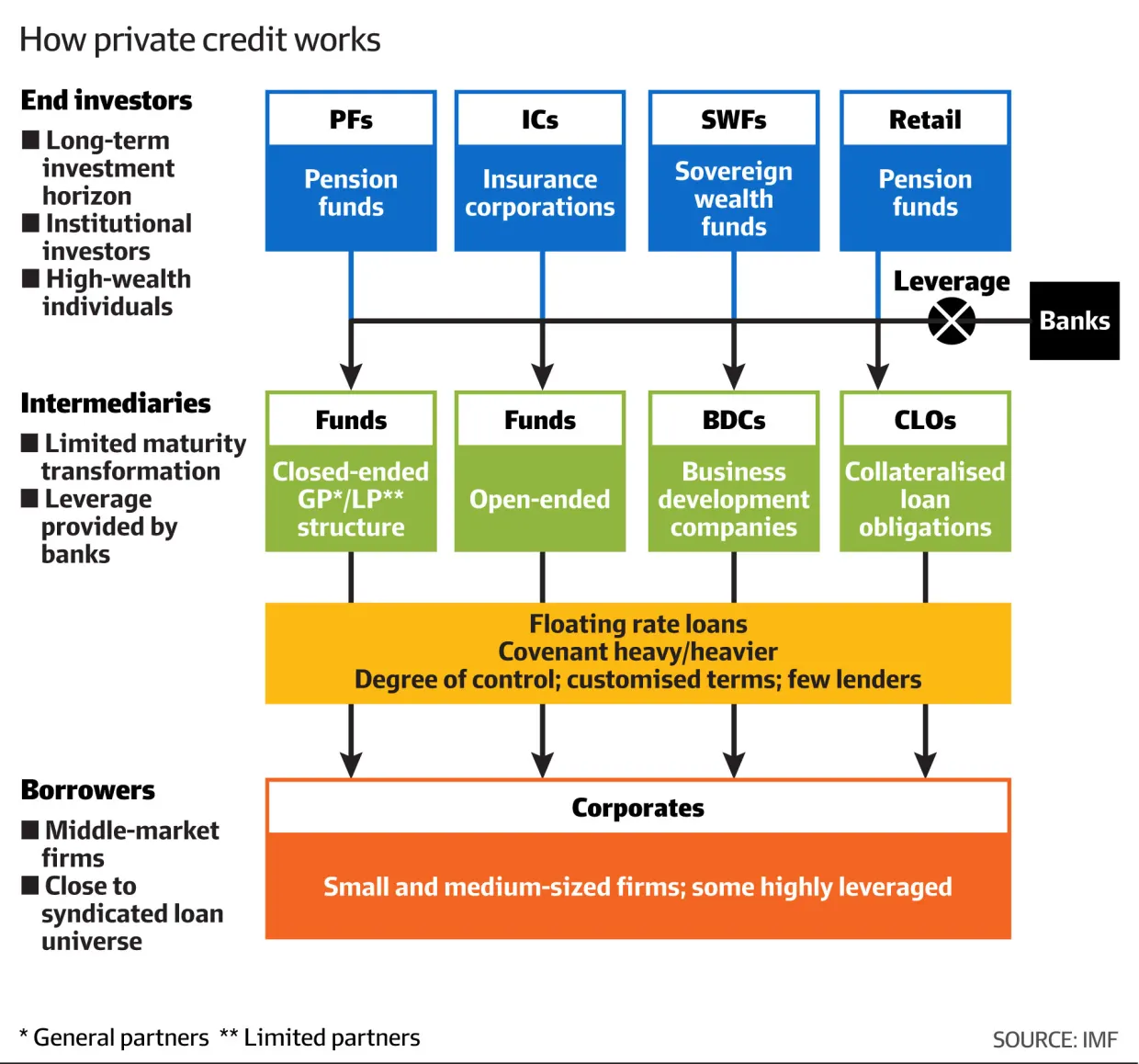

Alternative capital provides businesses with flexible funding solutions outside traditional bank financing or as a supplement to it. It includes non-bank lending options such as private credit, venture debt, private equity, and government-backed funding. These sources offer businesses access to capital when banks may have stricter lending criteria or limited appetite for certain industries.

Many businesses seek non-bank funding for growth, expansion, or restructuring without the constraints of traditional banking. Private lenders assess funding requests based on business potential rather than rigid credit scores or collateral requirements. This makes alternative capital an ideal solution for businesses in property development, agribusiness, infrastructure, manufacturing, and other industries requiring tailored financial solutions.

Fund Acquisition and Merges

Benefits of Alternative Capital for Borrowers

- Flexible Loan Structures – Customized funding solutions based on business needs, not rigid banking requirements.

- Faster Access to Capital – Quicker approval and funding processes compared to traditional banks.

- Higher Risk Appetite – Suitable for businesses banks may consider too risky.

- Growth-Focused Financing – Supports expansion, acquisitions, and working capital needs.

- Complementary to Bank Loans – Can be used alongside traditional banking to enhance cash flow and financial flexibility.

- Alternative capital gives businesses the financial tools needed to thrive, whether banks say “yes” or “no.”

Acquisition Finance Australia $50 million plus

Why Use Private Credit?

Private credit is a form of alternative capital, offering non-bank financing to businesses with unique funding needs. Unlike traditional banks, private credit providers offer flexible, tailored solutions for industries seen as higher risk.

Sectors like infrastructure, property development, and agribusiness often require long-term funding that banks may not provide.

Companies turn to private credit for faster approvals, customized loan structures, and access to larger funding amounts. Private lenders assess risk differently than banks, focusing on business potential rather than rigid credit criteria.

This allows businesses with complex financial needs to secure funding for growth and expansion.

Private Credit for Real Property

- Bridging and Construction loans

- Green field land-banking, options

- Commercial / Industrial / Retail

- Senior, mezz, structured solutions

- Unlisted Property Investment Trust

Private Credit for Growth

- Equity and JV partnerships

- Structured debt and equity financing

- Project and asset linked

- Capex Optimization

- Hybrid or Convertible Notes

Private Credit for Buyouts

- Facilitates your market expansion strategy

- Mezzanine debt and equity financing

- Leveraged buy-outs or buy-in

- Term loans 3 to 7 years

- Convertible Notes from $2-20M

Private Credit Turnaround

- Specialist equipment and infrastructure

- Fund up to 100% of cost of asset

- Open credit facilities. Line of Credit

- Operating and finance leases

- Global trade and invoice facilities

Raise Private Capital

Benefits of Private Credit for Borrowers

- Flexible Terms – Customized financing structures suited to unique business needs and cash flow cycles.

- Faster Access to Capital – Quicker approvals and funding compared to traditional bank processes.

- Higher Loan Amounts – Access to larger funding options without strict collateral requirements.

- Long-Term Financing – Supports large-scale projects requiring extended repayment periods.

Industry-Specific Solutions – Designed for businesses in sectors banks may consider high risk.

Private credit empowers businesses with alternative funding solutions, driving growth and innovation where banks may hesitate.

Key Trends in Private Credit

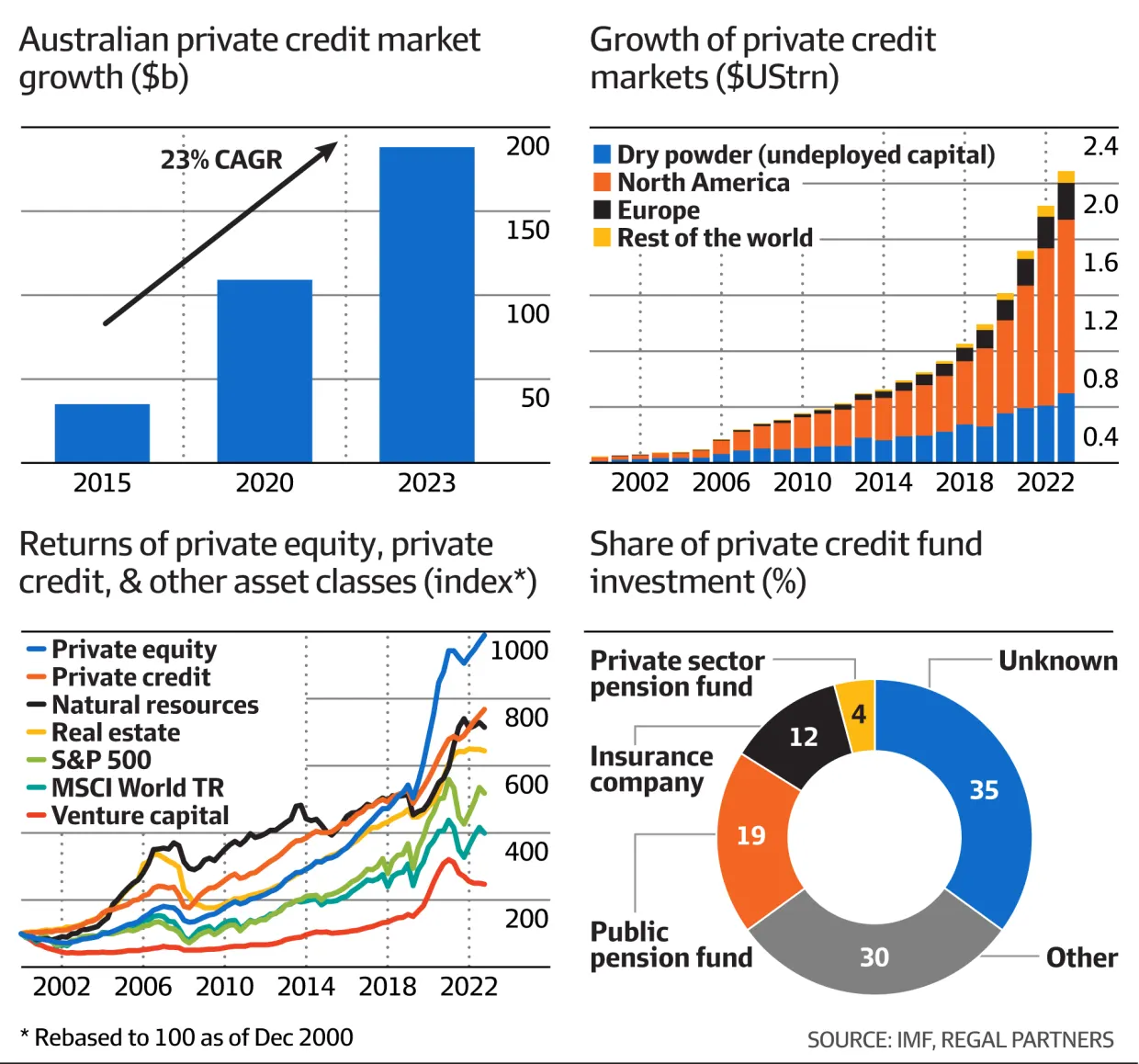

Australia’s private credit market has experienced notable growth in recent years, reflecting global trends in alternative financing.

Market Expansion

As of 2024, Australia’s private credit assets under management reached approximately AUD 200 billion, marking a 6% increase from the previous year. Despite this growth, private credit still represents a relatively small portion of the total business-related loan market, indicating potential for further expansion.

Factors Driving Growth

- Several factors contribute to the rise of private credit in Australia:

Bank Lending Constraints: Post-global financial crisis regulations have led traditional banks to tighten lending criteria, prompting businesses to seek alternative funding sources. - Investor Demand: Investors are increasingly attracted to private credit due to its potential for higher yields and diversification benefits, especially in a low-interest-rate environment.

- Economic Conditions: Volatility in equity markets has made private credit’s floating interest rate structures more appealing, offering resilience amid economic uncertainties.

Emerging Trends

Key developments in Australia’s private credit landscape include:

- Diversification of Sectors: While traditional areas like acquisition finance and property development have seen a slowdown, there’s increased activity in structured and asset finance sectors.

- Institutional Participation: Major institutional investors, such as superannuation funds, are allocating more capital to private credit, recognizing its potential for stable returns.

- Regulatory Focus: Regulators are enhancing scrutiny and transparency in the private credit market to ensure sustainable growth and protect investors.

In summary, Australia’s private credit market is poised for continued growth, driven by both demand from borrowers seeking flexible financing and investors pursuing attractive risk-adjusted returns.

INVEST IN AUSTRALIA

Private Capital for Growth

Structured Solutions for Property Development

Solutions for projects that fall outside the traditional banks lending criteria.

- Stretched senior construction debt (combine asset-based and cash flow loans for higher LVR, or Mezzanine structure).

- Preferred equity, hybrid and Joint Venture finance.

- Specialist security property such as purpose built or multi-purpose such as motels, childcare center’s, petrol station or caravan parks, aged care and infrastructure.

- Investment funding land-banking, sub-divisions, residual stock, distressed purchase, rural and regional property.

- Land-banking to assist with purchasing site pending design, re-zoning and DA approvals.

- No pre-sales, private investment funding rates 7% to 15%. LVR’s to To 75% of GRV.

- First and second commercial mortgages. Fast settlement for Caveats and Bridging loans.

- Assessed on strength of Sponsor’s property experience, site zoning use, area and demonstrated growth potential.

Non-Bank Alternative Capital Enquiry

This is not an application, no credit check.

Global Project Funding

We can help

Acquisition Opportunities

We can help

Private Debt Strategies

We can help

Mezzanine or Pref Equity

We can help

Purchase or Contract Finance

We can help

Import and Export finance

We can help

Corporate Bond Raise $20M +

We can help

Warehouse Credit Facility Funding

We can help

The content provided on this website is of a general nature and is not tailored to any specific individual or entity, nor does it address any particular needs, investment objectives, or legal, accounting, regulatory, taxation, or financial situations. In the preparation of this website, we have not taken into consideration your goals, financial standing, or needs. It is recommended that you seek qualified financial or other professional advice regarding any specific matter or circumstances related to investment. The content presented on this website should not be construed as financial, investment, or professional advice, and no information contained herein should be considered as a financial recommendation or expert statement on any matter.