Capital Raising Australia

Non-Bank and Private debt & equity for unlisted Australian companies. Seeking to fund acquisition, growth and property development from $5 to $30 million plus.

Property Development

Private capital solutions for property projects, construction, land-banking, sub-divisions

Venture Debt

Raise private venture capital or convertible notes for expansion or launch new projects

Non-Bank Debt & Equity

Partnering with local and global alternative fund managers for private capital

Raising capital in Australia is essential for businesses seeking growth, expansion, or new opportunities. At Accrutus, we provide expert capital raising Australia solutions, connecting businesses with strategic investors and funding sources. Our tailored approach ensures you secure the right funding through private equity, venture capital, or debt financing.

With years of experience in investor services, we help businesses navigate complex financial landscapes and attract the right investors. Our network includes high-net-worth individuals, institutional investors, and alternative funding options. Whether you’re a startup or an established company, our expert guidance streamlines the capital-raising process.

Accrutus offers end-to-end solutions, from structuring investment proposals to securing funding and managing investor relations. Our focus is on aligning businesses with investors who support long-term growth. If you’re looking for capital raising Australia services that drive success, partner with us today.

Issuer Investor Services

- Provide a scalable and proven model

- Be investor ready before you promote

- Understand who your investors are

- Offer a realistic and attainable exit

- Structure your management team

- Promote through a compliant process

- Seek external legal & accounting advice

- Engage a compliant capital raising advisory firm to avoid the pitfalls

Capital Raising Essentials

- Proven business model & solid execution plan

- Unique IP and a clear competitive advantage

- Disrupt an existing market or create new one

- Dynamic and amenable management team

- Expected return on Investment of 25% of higher

- Exit strategy as trade sale or IPO in 3 to 5 year

- Essential that your business opportunity is investor ready with high barriers to entry

Capital Raising Process

- Evaluation of the business opportunity

- Getting the business model investor ready

- Key components of a successful Offer or Exit

- Professional presentation of your opportunity

- Reasonable valuation versus risk and reward

- Targeting the right investment channels

- Negotiating terms, shareholdings and exits

- Fulfilling your obligation to investors

Table Of Content

Non-Bank Debt & Equity Finance

Why Raise Capital?

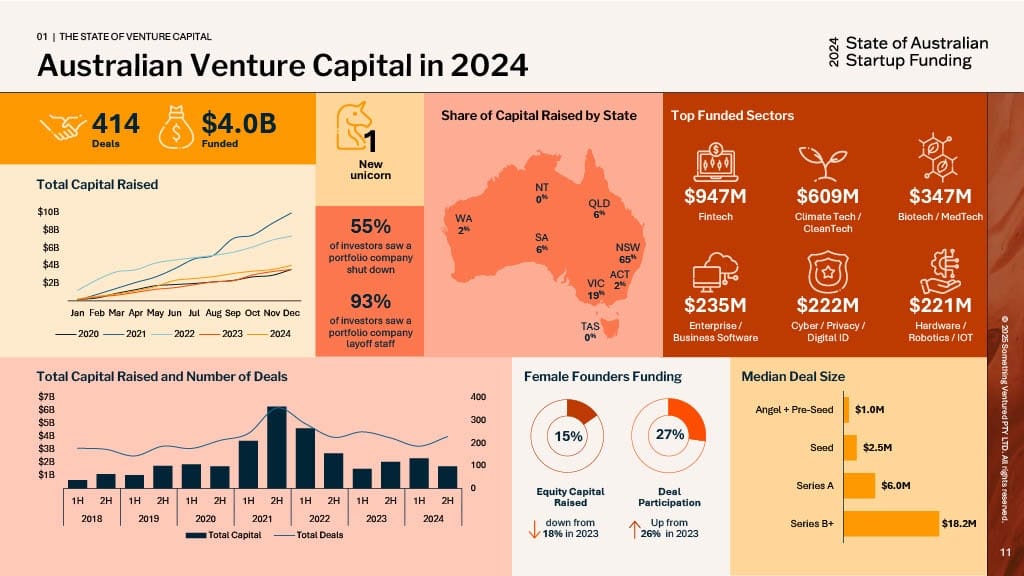

Raising capital is essential for businesses looking to scale, innovate, or enhance operations. **74%** of Australian startup founders plan to raise capital in the next year, while **80%** are confident they’ll raise their next round. (Source: State of Australian Startups)

Here’s why securing funding through Accrutus Capital Raising Australia can be a strategic move:

Expand Business Operations – Secure funding to scale production, enter new markets, or increase capacity.

Innovate & Develop New Products – Invest in research, product development, and technology to stay competitive.

Improve Cash Flow & Liquidity – Strengthen financial stability and ensure smooth business operations.

Attract Strategic Investors – Gain more than funding—leverage expertise, networks, and industry knowledge.

Increase Market Share – Access capital to outpace competitors and solidify your position in the industry.

Support Mergers & Acquisitions – Use funding to acquire competitors, expand portfolios, or create synergies.

Enhance Brand & Marketing – Invest in advertising, digital presence, and brand-building strategies.

Strengthen Investor Relations – Leverage professional investor services to build trust and long-term partnerships.

Optimize Debt & Equity Structure – Balance financing options for sustainable growth and reduced financial risk.

Future-Proof Your Business – Secure capital to adapt to market shifts, economic changes, and industry trends.

With expert Accrutus Capital Raising Australia solutions, we help businesses secure debt and equity finance that aligns with your long-term goals.

Key Capital Raising Considerations

When considering raising private capital, it’s crucial to evaluate several key factors to ensure successful funding:

Market Conditions: As of 2025, venture capital markets are rebounding, driven by advancements in AI and a resurgence in IPO activity.

Regulatory Environment: Favorable regulatory developments are contributing to a healthier venture capital landscape.

Investment Trends: In 2024, its reported that 51% of investors believe capital raising activity will increase in 2025, down from 67% in 2023. (Source: State of Australian Startup Funding)

Technological Advancements: The rise of AI presents significant opportunities for venture capital investments.

Exit Strategies: A rebounding IPO market in 2025 offers more avenues for investor exits.

Interest Rates: A higher-for-longer interest-rate environment necessitates careful consideration of financing costs.

Investor Relations: Engaging with professional investor services can enhance credibility and attract strategic partners.

Risk Management: Identifying potential risks and developing mitigation strategies is essential for investor confidence.

To increase your chances of success, it’s essential to be Investor Ready understanding funding challenges, market conditions, and the extensive due diligence process.

Investor services play a crucial role in building credibility, securing funding, and strengthening investor relations. With interest rates remaining high and valuation trends shifting, businesses must optimize their financial structures and risk management strategies.

At Accrutus, we provide tailored investor services, connecting businesses with the right investors and funding opportunities. Whether you’re expanding, innovating, or seeking strategic partnerships, our expertise ensures you secure funding aligned with your growth goals.

Enquiry for Private Debt & Equity

This is not an application, no credit check.

Seeking private capital investment

We can help

Have traction but not yet profitable

We can help

Not a fit for traditional banking

We can help

Seeking JV equity partner for scale

We can help

Leveraged Buy-ins and Buy-outs

We can help

Planning a Pre-IPO raise

We can help

Issue a Corporate Bond $20M +

We can help

Raising Funds for Warehouse Credit Facility

We can help

The content provided on this website is of a general nature and is not tailored to any specific individual or entity, nor does it address any particular needs, investment objectives, or legal, accounting, regulatory, taxation, or financial situations. In the preparation of this website, we have not taken into consideration your goals, financial standing, or needs. It is recommended that you seek qualified financial or other professional advice regarding any specific matter or circumstances related to investment. The content presented on this website should not be construed as financial, investment, or professional advice, and no information contained herein should be considered as a financial recommendation or expert statement on any matter.

Raising private capital in Australia is a meticulous process that requires companies to be Investor Ready and compliant with ASIC’s guidelines.

Governed by the Corporations Act 2001 and regulated by ASIC, capital raising involves providing accurate and legally binding documentation to potential investors.

Demonstrating a compelling investment opportunity and showcasing the potential for a successful exit event are crucial aspects of attracting investor funds.

Partner with Accrutus Capital, a professional boutique Corporate Placement firm, to ensure your business is prepared for investment through the Accrutus Capital Raise Program.

Capital Raising stages for private companies

Seed

Founders / family / friends / followers

$100K – $500K

Idea Development

Produce Prototype

Proof of Concept

Early Stage

Angels & HNW professionals / Micro VC

$600K –$3M

Proven business model

Shows initial revenue

Break-even or negative

Expansion Stage

Venture Capital / Family Offices / Funds

$5M – $20M

Selling products

Maybe profitable

Expand market

Exit Stage

Private Equity / Pre-IPO and List

$20M – $50M +

Established market

Significant revenue

Trade Sale or Exit

Successful capital raising programs hinge on aligning with potential investors. Starting with the management team and the growth strategy. The primary obstacle to securing funding often lies in the valuation and agreed-upon method used to determine your company’s worth. Reach out to investor services organisations to conduct a comprehensive investor-ready analysis. “How much is your company worth?

Comparable Company Analysis

Evaluating comparable companies using current valuation metrics based on market prices.

Discounted Cash Flow Analysis

Valuation involves projecting future cash flows and using the NVP method for net worth.

Precedent Transaction Analysis

Analyze past valuations of deals with similar industry and multiples for strategic insights.